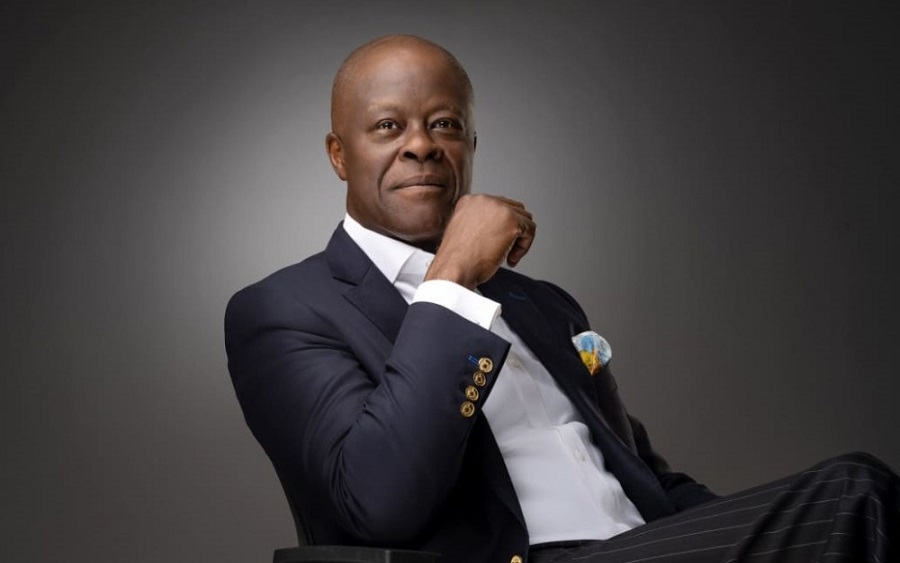

O’tega Ogra Urges Nigerians to Shun Negativity, Embrace Credit Culture and Smarter Financial Choices

Senior Special Assistant to the Nigeria President on Digital Media, O’tega Ogra, has advised Nigerians, particularly entrepreneurs and salaried workers, to rise above the culture of negativity and embrace responsible credit systems as a tool for improving their lives and building sustainable wealth.

In a reflective note shared recently, Ogra criticized what he described as a “gospel of perpetual negativity” that discourages belief in Nigeria’s opportunities while its promoters quietly thrive.

“If you build your life on the gospel of perpetual negativity, don’t be surprised when those same voices quietly open amala joints and businesses in the same Nigeria they told you to hate, whilst your own life stagnates from listening to them,” Ogra wrote.

He highlighted that corruption and financial inefficiencies in Nigeria are partly driven by the obsession with paying cash upfront for everything, instead of leveraging structured credit responsibly. According to him, compact and fuel-efficient cars—including electric and hybrid vehicles—are within reach for many Nigerians if they adopt smarter financing models.

Using his personal experience, Ogra recalled buying his first new car in 2010 by financing through a commercial bank rather than cash down or staff loans, noting that credit allowed him flexibility in his career and finances.

He explained that with a 20–40% down payment and youth/women-focused bank loans at ~17% per annum spread over 60 months, Nigerians can access new cars priced between ₦12–18 million, with manageable monthly repayments of about ₦238,600 for salaried workers earning around ₦650,000 per month.

While acknowledging that this is above Nigeria’s minimum wage, Ogra stressed the need to rapidly expand public transportation systems such as light rail, Bus Rapid Transit (BRT), and CNG-powered mass transit, many of which are currently being supported by President Bola Tinubu’s administration across states like Kaduna, Kano, Ogun, and Lagos.

Ogra further encouraged Nigerians to embrace needs-based consumption over luxury-driven spending, pointing out that compact cars are the norm in developed economies, not luxury SUVs.

“Don’t let anyone gaslight you into believing a new car is impossible, or that only luxury SUVs count. Buy what meets your needs, not their noise,” he advised.

Impact

His message underscores the importance of financial literacy, responsible borrowing, and mindset shifts in fostering personal growth and national development. By encouraging Nigerians to live within their means, invest wisely, and leverage credit, Ogra positions financial responsibility as a pathway to both personal advancement and a stronger economy.